Quarterly solar and wind installations in the US have fallen to their lowest levels in three years, with battery storage alone among the three main clean energy technologies making a strong showing.

Although the US’ clean energy sector faces a bright future in the years ahead, this year’s third quarter has been a difficult one, particularly for solar installations, according to the American Clean Power Association (ACP).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

ACP merged at the beginning of this year with the national Energy Storage Association and incorporates energy storage market trends and data into its Clean Power Quarterly market report.

A total of 3.4GW of new capacity came online across the three technologies between July and September. While quarterly wind installations fell by 78%, solar PV by 18% and overall installations 22% versus the third quarter of 2021, battery storage had its second-strongest quarter to date, making up 1.2GW of the total, a 227% increase.

Going forward, although the report highlighted challenges faced in terms of supply chain delays and lengthy interconnection queues, it emphasised the positive outlook ahead, particularly in light of the Inflation Reduction Act adding long-term certainty to existing incentive programmes and introducing tax credit incentives for standalone energy storage.

Of a total operating capacity of 216,342MW of clean energy assets in the US by the end of the reported period, 8,246MW is battery storage output with 20,494MWh of storage capacity. That compares to just under 140,000MW of onshore wind, just over 68,000MW of solar PV and just 42MW of offshore wind.

During the quarter, ACP found that 17 new battery storage projects were commissioned, adding up to 1,195MW/2,774MWh, while in the year to date, 3,059MW/7,952MWh has been installed.

That highlights just how rapidly that installed base is growing, especially when figures previously published by ACP, showed a total of 2.6GW/10.8GWh of grid-scale battery storage installations were deployed for the whole of 2021.

Perhaps less surprisingly, California is the leading US state for battery deployments, with 4,553MW of operational battery storage. Texas, thanks to more than 37GW of wind, is the leading state for overall operational clean energy capacity, but California is the leader in solar as well as battery storage with 16,738MW of operational PV.

‘Aggressive storage deployment drives down consumer energy costs’

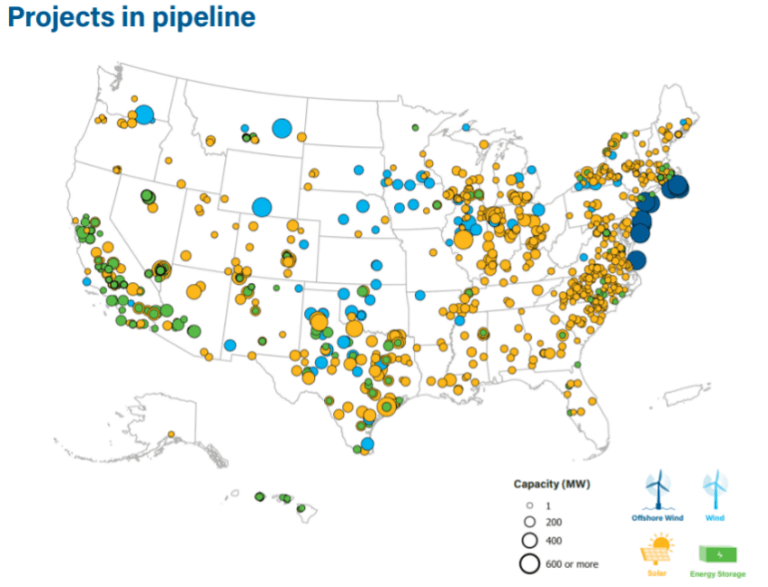

Of the US’ overall clean power pipeline of projects in development, nearly 60% – just over 78GW – is solar PV, but there were 14,265MW/36,965MWh of storage capacity in development. Nearly 5.5GW of that storage pipeline is in California, followed by Texas with just over 2.7GW. Nevada and Arizona are the only other two states with pipelines in excess of a gigawatt, with both around the 1.4GW mark.

It was a similar story for grid interconnection queues, with the highest amount of battery storage waiting for grid connection in California’s CAISO market, 64GW. Texas’ ERCOT deregulated market had the next highest storage queue with 57GW while PJM Interconnection wasn’t far behind with 47GW.

Finally, just under a tenth of clean power capacity in construction at the end of the third quarter was battery storage, 3,795MW out of a total 39,404MW.

Much of the downturn in solar PV and wind installations was due to delays caused by various factors, with almost 14.2GW of capacity experiencing delays, more than half of which had already been delayed in a previous quarter.

Solar PV modules are in short supply in the US market due to ongoing trade restrictions and anti-dumping countervailing duties (AD/CVD), and what ACP Interim CEO and chief advocacy officer JC Sandberg said was “an opaque and slow-moving process at US Customs and Border Protection”.

Elsewhere, other supply chain constraints hit the wind industry and although they hit the battery storage sector too, the impact has not been as acute, ACP found. The most delayed energy storage projects were co-located or hybrid solar-plus-storage projects, slowed down by the solar portion facing logistics issues.

Sandberg said that while the Inflation Reduction Act is set to catalyse growth in the clean energy industry, certain aspects of policy and regulation are holding development and deployment back.

“The solar market has faced repeated delays as companies struggle to obtain panels as a result of an opaque and slow-moving process at US Customs and Border Protection. Policy uncertainty around tax incentives constrained wind development, underscoring the near-term need for clear guidance from the Treasury Department so the industry can deliver on the promise of the IRA,” Sandberg said.

“Storage was the one bright spot for the industry and had its second-best quarter on record. The aggressive deployment of storage continues to drive down consumer energy costs and enhance grid reliability.”

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 28-29 March 2023 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.